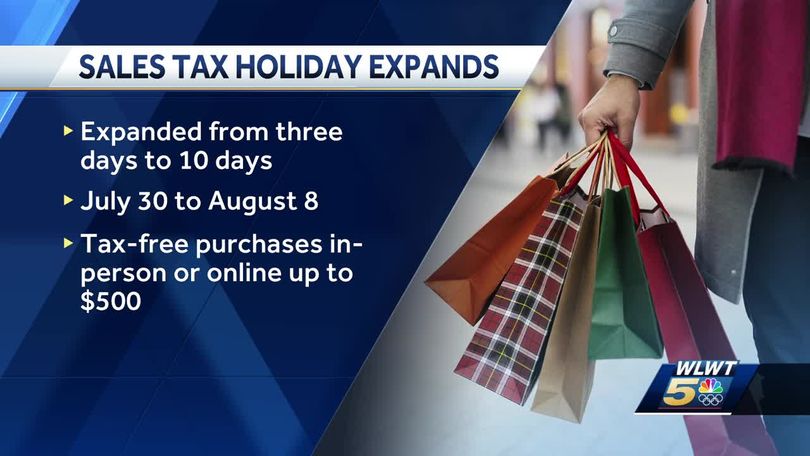

Residents of Ohio can make tax-free purchases of items under $500 from July 30 to August 8, which is a 10-day shopping period. This initiative promotes local spending and provides support to businesses in the area. Sales tax will not be charged on the eligible purchases made during this period.

Ohio‘s Extended Tax-Free Shopping Window Includes Restaurant Meals and Online Purchases

This Article Includes

The Columbus Dispatch reports that Ohio is extending its tax-free shopping period this year, running from July 30 to August 8. This 10-day period allows shoppers to purchase clothing and electronics without paying sales tax, provided each item costs $500 or less. The best part? This deal also applies to online purchases, regardless of delivery date. However, it’s important to note that big-ticket items such as cars and boats, as well as alcohol, are not included in this tax-free promotion.

Residents in Central Ohio, with tax rates ranging from 6.75% to 8%, can take advantage of the tax holiday to save money on their daily purchases. Franklin County has a tax rate of 7.5%, and Delaware County’s rate is 7%. This year, in addition to everyday items, the tax holiday also includes meals at restaurants, excluding alcoholic beverages that are still taxed.

From July 30 to August 8, Ohio is holding a 10-day sales tax holiday where consumers can buy tax-free items for $500 or less. A photo from WFIN shows the announcement of the event which will allow shoppers to save money on their purchases.

Ohio Stores Gear Up for Increased Foot Traffic During Extended Tax-Free Shopping Period

With the holiday season just around the corner, retailers are gearing up to accommodate an influx of shoppers, both in-store and online. The objective of this prolonged tax break is to incentivize consumers to spend their money within their local communities and help bolster local businesses, especially as families gear up for back-to-school shopping. This presents a unique opportunity for shoppers to save some cash while simultaneously giving their local economy a much-needed boost.