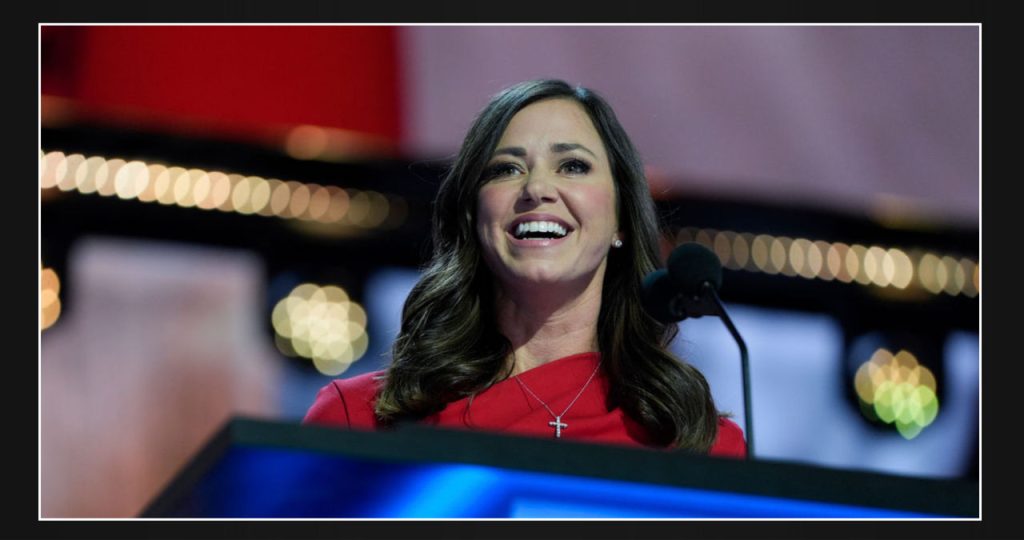

On Wednesday, two bills were introduced by U.S. Senators Katie Britt (R-Ala.) and Tim Kaine (D-Va.) to address the pressing child care crisis and provide assistance to families, workers, and businesses.

The proposed legislation aims to enhance the accessibility and affordability of child care for families while also providing financial incentives for child care workers and businesses. The bills seek to broaden tax credits for parents and allocate more resources for local businesses to support child care.

On Wednesday, Britt shared that she and her husband, Wesley, faced their own set of difficulties during their experience as new parents. She stated that their proposed legislation aims to make childcare more affordable and accessible, ultimately saving money for families who work hard to provide for their children.

According to the Center of American Progress, over 50% of American families reside in child care deserts. The Women’s Foundation of Alabama revealed that in 2022, around 85,000 families in Alabama were in need of child care services but had no access to affordable and quality options within their localities.

In the past thirty years, child care expenses have skyrocketed by 220%, resulting in families facing difficult decisions between work, paying bills and providing child care. Mothers in Alabama have even shared heart-wrenching stories of having to declare bankruptcy or being forced to choose between purchasing basic household necessities like toilet paper and covering the cost of child care.

According to a report by the Council for a Strong America, the country’s economy incurs losses of $122 billion annually due to these choices.

Britt expressed that high child care costs often force parents to consider the financial feasibility of returning to work. For many, the cost is simply unaffordable, leaving them with few viable options.

Furthermore, child care workers are facing financial difficulties as their wages are insufficient, leading some of them to consider leaving the industry for better pay. Meanwhile, child care providers are struggling to keep their businesses running due to financial constraints.

According to Britt, this new legislation will offer relief to all involved parties. Kaine also expressed his pride in working on the matter in a news release.

Camille Bennett, the founder and executive director of Project Say Something and three child care centers in North Alabama, believes that previous tax credit programs in Alabama have mainly favored big businesses, neglecting low-income families and child care workers who also need support to stabilize the industry.

According to Britt, the legislation has a good chance of passing and she considers it to be a realistic approach.

The proposed legislation aims to enhance the Child and Dependent Care Tax Credit, which differs from the Child Tax Credit. It would increase the credit’s size and make it refundable, enabling low-income working families to benefit from it for the first time. This proposal extends the maximum tax credit to $2,500 for families with one child and $4,000 for families with two or more children, providing them with a substantial boost.

Families can now look forward to a strengthened Dependent Care Assistance Program if the proposal gets approved. The program will see a 50% increase in the amount of expenses that can be deducted, now up to $7,500.

Britt has proposed a plan that aims to strengthen the Employer-Provided Child Care Tax Credit. The plan involves increasing the maximum credit from $150,000 to $500,000 and increasing the percentage of expenses covered from 25% to 50%. This move aims to incentivize businesses to offer child care services to their employees.

Small businesses will receive a boost from the new legislation, which features a maximum credit of $600,000 as an incentive. Additionally, groups of small businesses will be able to make joint applications and pool their resources.

According to Britt, the small businesses that line the main streets of our communities are what give them their unique character. It is their success that is crucial, and Britt is confident that this new initiative will be a game changer for many of them.

The Child Care Workforce Act aims to assist child care workers by introducing a competitive grant program for states, localities, tribes, and tribal organizations interested in implementing or expanding pay supplement programs. The goal is to reduce turnover and provide better support for those in the child care industry.