AEP Ohio and Intel have come to an agreement and are currently seeking approval from state regulators. The deal entails AEP Ohio providing electricity to Intel’s massive 1,000-acre site in Licking County. The amount of energy generated is so immense that it has the capability to power up to 450,000 homes.

Under an agreement filed with the Public Utilities Commission of Ohio, AEP Ohio is set to supply 500 megawatts of electricity to the location where Intel is investing $28 billion in constructing two factories.

The two factories, along with other operations around the plant, will be powered by electricity.

In the filing, the companies stated that the proposed agreement aligns with Ohio’s state policy to promote the growth of high-tech manufacturing and to attract Intel to establish its new facilities in Licking County. Furthermore, they asserted that approving the agreement would signify the commission’s agreement with policymakers at all levels of government who recognize the significance of the new Intel facilities. The companies emphasized that these facilities not only provide immense economic benefits but also address national security and supply chain concerns by onshoring semiconductor manufacturing.

Under a provision in Ohio state law, the companies have filed for a “reasonable arrangement” that will support Intel’s investment and drive economic development and job growth in the state. As part of this arrangement, Intel will pay a modified rate for electricity, though the filing did not disclose the specific amount.

Ohio has utilized it as a tool before, and even Amazon has employed it as part of their expansion of data center operations in central Ohio.

Intel’s project is set to generate 3,000 jobs, with an annual payroll of $405 million, while also creating several thousand construction jobs. This $28 billion investment marks the biggest economic development project in the history of the state.

Intel is currently focusing on developing its site, but unfortunately, the company is facing financial difficulties. In its recent financial report released on Thursday, they disclosed weak financial results, and as a result, they will be downsizing their workforce by more than 15%, which equates to almost 19,000 job cuts.

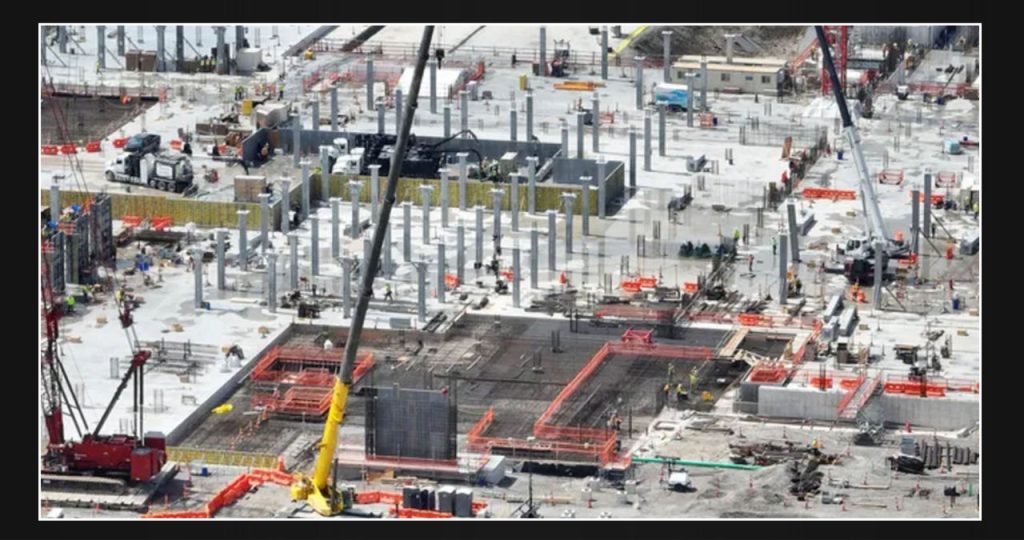

Intel has yet to announce a specific date for the opening of their factories. According to the semiconductor company, construction on such projects can take up to five years from the time of breaking ground, which occurred in September 2022.

In a statement, Intel expressed their gratitude for the partnership with AEP. They acknowledged that the agreement on rates would not only help them fulfill their pledge to generate numerous high-paying job opportunities but also enable them to make further investments in Ohio’s development. Intel eagerly awaits the review of the Public Utilities Commission of Ohio and anticipates the positive effect this collaboration will have on the community.

Maureen Willis, the Ohio Consumers’ Counsel, expressed her approval of the proposal.

In a statement, she expressed her approval of Intel’s economic development proposal submitted to the PUCO. She believes that the proposal is favorable, as it has limited costs charged to utility consumers while providing a significant boost to Ohio’s economy. For her, it’s a win-win situation for the people of Ohio.

Data centers spurring huge demand for electricity from AEP

This Article Includes

AEP is currently experiencing the largest increase in power demand in decades, which can be attributed to the significant expansion of data centers. This development has prompted the filing of the aforementioned report.

According to AEP, the demand for power from data centers in Ohio is incredibly high. In fact, it is predicted that in the near future, the amount of electricity used in central Ohio will be comparable to that of Manhattan.

According to power consumption estimates, the 500 megawatts generated by the Intel site would not only be sufficient to power the 275,000 single-family homes in Franklin County but also exceed their needs.

During its second-quarter earnings call last week, AEP revealed that it predicts a significant surge in power demand of over 40% in its 11-state footprint by the end of the decade. The company also reported a 12.4% increase in demand for power from commercial customers over the past year, largely due to growth in Ohio and Texas.

During a recent conference call with analysts, interim AEP CEO Ben Fowke expressed his support for innovative solutions to meet the energy needs of customers, including data centers. However, he also stressed the importance of allocating costs associated with these large loads in a fair manner and making investments that support the long-term success of the grid.

Intel, AEP agreement will allow AEP to meet power demands at the site, companies say

According to the PUCO filing, the proposed agreement will assist AEP Ohio in fulfilling its requirements by providing an affordable solution that encourages Intel’s continuous investment in Ohio and showcases the state’s openness to high-tech manufacturers.

According to the filing, Intel’s project requires a significant amount of energy due to the size of the load, as well as the need for high-quality power to operate their technical and sensitive semiconductor manufacturing equipment.

In addition to the factories, the site will also house various other facilities including offices, air separation machines, a water recycling plant, and data centers.

AEP Ohio has announced its intentions to construct a new station, the Green Chapel Station, which will cater to the Intel area and seamlessly integrate with the current transmission network of AEP Ohio. The company has revealed that it will be adding two new transmission lines, designed in a way to ensure the delivery of increased power.

According to AEP Ohio, the construction of the station is expected to cost around $95.1 million.

Under the agreement, the PUCO mandates that Intel must submit yearly reports until their investment in the factories surpasses $20 billion.

According to the filing, in case Intel needs more than 500 megawatts of power, the company would need to either reduce its demand on site or find an alternative solution to meet its power requirements.

In the event that Intel fails to fulfill its commitment to invest $20 billion or decides to terminate the agreement, it will be liable for covering the expenses associated with the Green Chapel station.